EBITDA is one of the most commonly used financial metrics in business analysis, yet it is also one of the most misunderstood. Whether you are an investor, entrepreneur, student, or financial analyst, knowing what EBITDA means and how it works can help you evaluate a company’s real financial health. This guide breaks down EBITDA in simple, practical terms so anyone can understand it.

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a financial indicator used to measure a company’s operating performance by focusing on the earnings generated purely from its core business activities.

By excluding interest, taxes, depreciation, and amortization, EBITDA helps show how profitable a business is before the effects of financing decisions, accounting policies, and tax environments.

EBITDA is widely used because it:

Many analysts also use EBITDA as a foundation for valuation methods like EV/EBITDA.

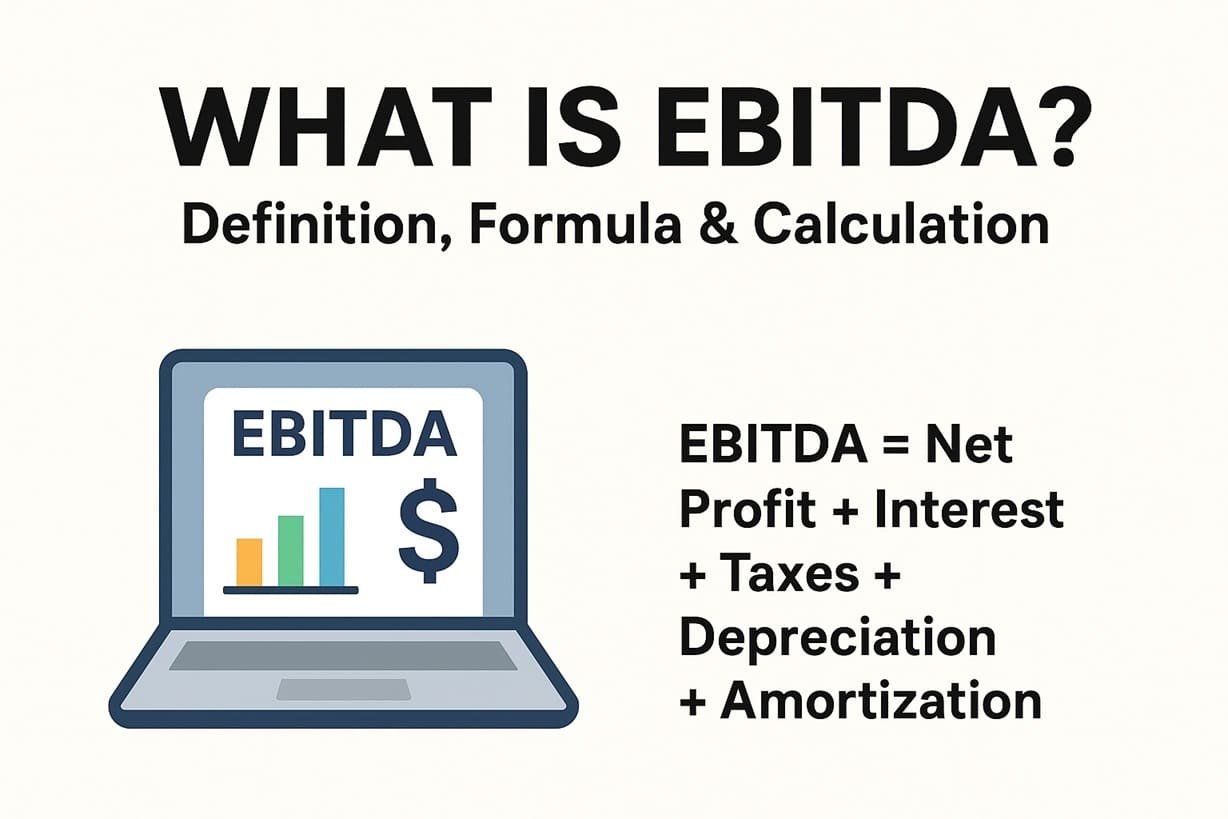

EBITDA can be calculated using two common formulas:

EBITDA = Net Profit + Interest + Taxes + Depreciation + Amortization

EBITDA = Operating Profit (EBIT) + Depreciation + Amortization

Both formulas lead to the same result, depending on which financial data is available.

This is the company’s final profit after all expenses, taxes, and interest have been deducted.

Interest is added back because financing decisions vary between companies and should not affect operating performance.

Tax rates can differ across countries and industries, so they are excluded to improve comparability.

A non-cash expense representing wear and tear on physical assets like equipment or buildings.

Another non-cash expense associated with intangible assets such as patents or software.

Suppose a company has the following annual financial data:

Using the standard formula:

EBITDA = 12,00,000 + 2,00,000 + 3,00,000 + 1,50,000 + 50,000

EBITDA = ₹19,00,000

This means the company generated ₹19 lakh from its core operations, excluding financing and accounting adjustments.

EBITDA is especially useful when you want to:

Although popular, EBITDA is not perfect. Some limitations include:

EBITDA should always be used alongside other metrics such as cash flow, net profit, and debt ratio.

EBITDA remains one of the most valuable financial tools for understanding a company’s operational performance. It strips away non-operational and non-cash factors, giving a clearer view of how efficiently a business is truly functioning. However, it should not be used alone when making important investment or business decisions. When paired with other financial indicators, EBITDA becomes a powerful metric that helps investors, founders, and analysts evaluate both performance and potential with greater accuracy.

Q1. What does EBITDA mean?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It shows a company’s profit generated from core operations.

Q2. Why is EBITDA important?

It removes the impact of financing decisions and non-cash expenses, making it easier to compare operating performance between companies.

Q3. Is EBITDA the same as profit?

No. Profit includes interest, taxes, depreciation, and amortization, while EBITDA excludes these to focus only on operating earnings.

Q4. How is EBITDA calculated?

EBITDA = Net Profit + Interest + Taxes + Depreciation + Amortization.

You can also use EBITDA = EBIT + Depreciation + Amortization.

Q5. Can EBITDA be misleading?

Yes. Since it excludes important costs like interest and taxes, it may make weak companies appear more profitable than they actually are.

Image Credits: Created by ChatGPT using DALL·E (OpenAI).

To know more about our platform, visit our About Us page.

Comments