Impulse buying is a challenge many people face, whether shopping online or in stores. Those unplanned purchases can quietly drain your finances and clutter your life. Learning how to avoid impulse buys isn’t about eliminating shopping entirely — it’s about becoming intentional with your money and making smarter purchasing decisions that align with your priorities. By adopting a few simple strategies, you can shop smarter, save money, and still enjoy the things that truly matter.

The first step in avoiding impulse purchases is recognizing the triggers. Emotional shopping, limited-time deals, flashy displays, and peer influence often lead to unplanned spending. Ask yourself: Are you buying because you need it, or because it feels good in the moment? Awareness of these triggers can help you pause and make conscious decisions.

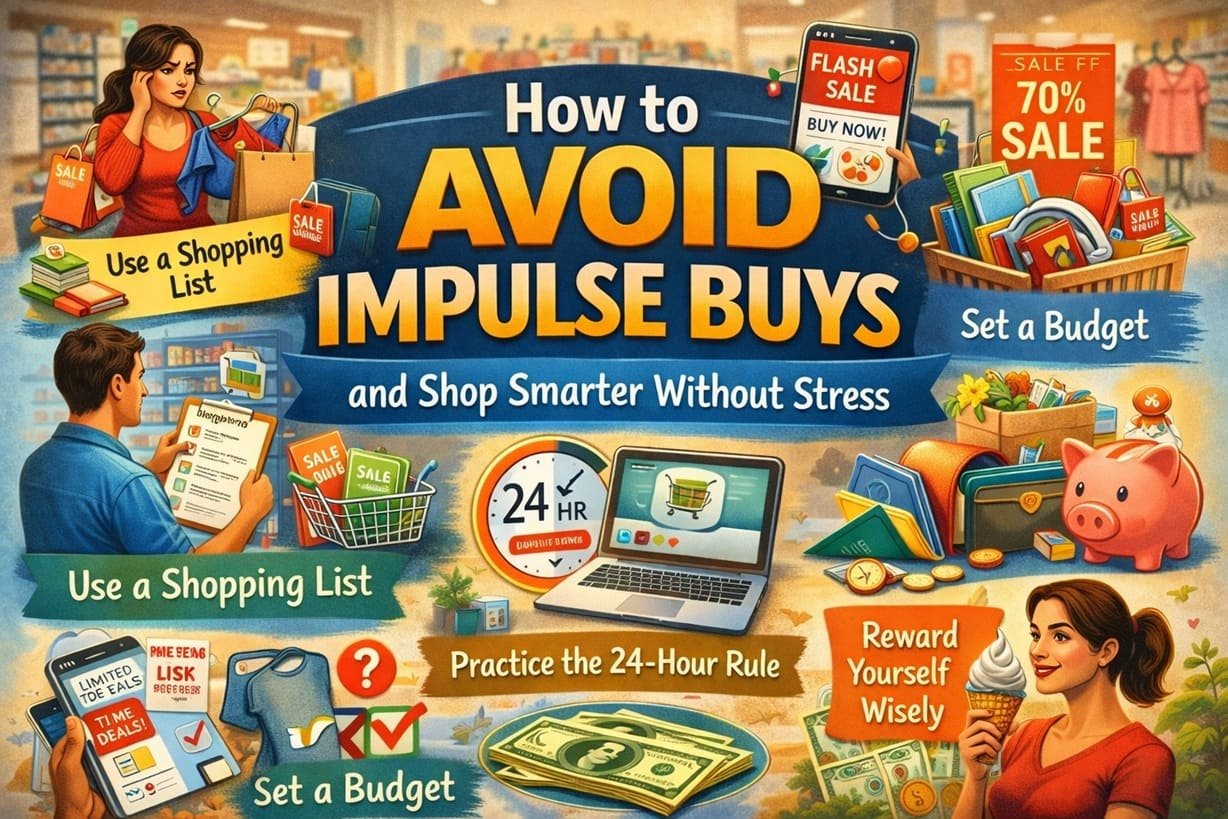

One of the most effective ways to prevent impulse buys is planning ahead. Before heading to a store or browsing online, create a list of what you actually need. Stick strictly to this list. When items catch your eye, ask yourself whether they are essential or just a tempting extra. This simple habit can save both money and stress.

A tried-and-true method for controlling impulse purchases is the 24-hour rule. If you see something you want but didn’t plan for, wait at least 24 hours before buying it. Often, the initial urge fades, and you’ll find the purchase isn’t as necessary as it seemed. This cooling-off period helps you make rational decisions rather than emotional ones.

Reducing opportunities to make impulse buys is key. Unsubscribe from promotional emails, avoid window-shopping for entertainment, and remove shopping apps from your phone’s home screen. By limiting exposure to tempting offers, you’ll naturally curb unplanned purchases.

Having a clear budget for discretionary spending makes it easier to resist impulse buys. When possible, use cash instead of credit cards for these purchases. Physically handing over money creates a stronger awareness of spending, making it harder to justify unnecessary items.

Before making any purchase, ask yourself if the item adds lasting value or happiness. Consider whether it will still be useful or meaningful in a month. Shopping with intention ensures your money goes toward items that genuinely enhance your life rather than momentary satisfaction.

Avoid shopping when you’re stressed, bored, or emotional. Emotional states often amplify impulse urges. Instead, schedule shopping trips when you’re calm and focused, and use lists and budgets as your guide. Mindful shopping turns a routine activity into a deliberate decision-making process.

Resisting impulse buys doesn’t mean eliminating all treats. Allow yourself occasional, planned rewards within your budget. These small treats satisfy your desire for enjoyment while reinforcing good shopping habits, creating a balance between saving and spending.

Avoiding impulse buys is about building mindfulness and control over your spending. By understanding your triggers, planning purchases, and evaluating the true value of items, you can shop smarter, save money, and reduce clutter in your life. Over time, these strategies create financial stability and a more intentional, fulfilling shopping experience.

Q1. What is an impulse buy?

An impulse buy is an unplanned purchase made on the spur of the moment, often driven by emotion rather than necessity.

Q2. How can I stop myself from impulse shopping?

Use strategies like shopping lists, the 24-hour rule, budgeting, and limiting exposure to tempting ads or promotions.

Q3. Does using a budget really help avoid impulse purchases?

Yes, a clear budget provides boundaries and helps prioritize spending on items that truly matter.

Q4. Are online sales more likely to trigger impulse buying?

Yes, flash sales and targeted ads are designed to create urgency. Pausing before buying can prevent unnecessary purchases.

Q5. Can rewarding myself help reduce impulse buying?

Yes, planned rewards satisfy your desire for treats without undermining your financial goals, promoting mindful spending.

To know more about our platform, visit our About Us page.

Comments